Financial results

Grupo Argos closed the first quarter with a net profit of COP 6.5 trillion as a result of transformational transactions

15 May 2024- With the successful closure in January of this year of the asset combination between Summit Materials and Argos USA, a leading platform in the construction materials sector with a national scale in the United States was created, with a company value of USD 9.5 billion, which represented a net profit of COP 5.3 trillion for Grupo Argos.

- Additionally, during the first quarter of the year, the company recorded a net gain of COP 2.5 trillion from the divestment in Grupo Nutresa.

- In the last 12 months, driven by solid financial results, the materialization of the announced transactions, and other value-revealing measures, the market capitalization of the listed companies of Grupo Empresarial Argos has increased by COP 15 trillion, thereby doubling its value.

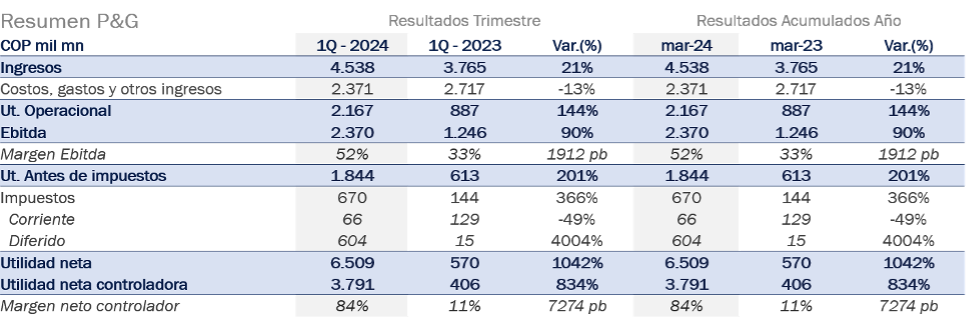

During the first quarter of 2024, Grupo Argos recorded consolidated revenues of COP 4.5 trillion and an EBITDA of COP 2.4 trillion, growing by 21% and 90%, respectively, compared to the same period of the previous year. Net profit closed at COP 6.5 trillion, and the net profit attributable to the parent company was COP 3.8 trillion.

“This quarter, we registered the results of significant milestones for Grupo Argos’ strategy as an infrastructure asset manager. We highlight the combination of assets between Argos USA and Summit Materials, which valued our operations in that country at USD 3.2 billion, and the agreement to divest Grupo Argos’ stake in Grupo Nutresa.”

Jorge Mario Velásquez

President of Grupo Argos

Cementos Argos continued its focus on profitability, resulting in EBITDA growth of 24% measured in USD and an EBITDA margin expansion of nearly 200 basis points compared to the previous year, despite the economic slowdown in several markets where it operates. Additionally, due to the share buyback program and the conversion of 99.8% of preferred shares into common shares, Grupo Argos’ economic interest in Cementos Argos increased from 51.3% at the end of 2023 to 53.4%, representing a 2% increase, which at market values is worth more than COP 200 billion.

During the quarter, Celsia demonstrated its ability to provide reliability to the electrical system amid the challenges posed by the El Niño phenomenon in the country’s power generation. This is the result of portfolio optimization in recent years towards a balanced generation mix involving hydroelectric, solar, and thermal energy. With the normalization of climatic conditions, Celsia is expected to close 2024 with a net profit similar to that recorded in 2023.

At Odinsa, airport traffic grew by 20%, leading the platform to handle 48 million passengers over the past 12 months, of which 42 million correspond to El Dorado International Airport, a record figure for the asset. This demonstrates the potential of this airport as a regional hub and as a gateway amid Colombia’s growing tourism demand. Meanwhile, the average daily traffic of the road platform remained stable, reaching 107,000 vehicles.

In the Urban Development Business, net cash flow for the quarter was COP 23 billion, a positive result considering the market slowdown. Regarding the Ciudad Mallorquín project being developed in Puerto Colombia, Atlántico, it is progressing while meeting all environmental, social, and legal commitments, additionally generating an unprecedented transformation for development and social inclusion in this region.

Summary of Consolidated Financial Results

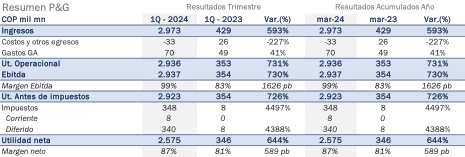

Summary of Separate Financial Results

Integral Value Generation: Well-being and Development

On the occasion of the tenth anniversary of its higher education scholarship program, Grupo Argos Foundation launched a new cohort with 30 new high school graduates from 15 departments in Colombia. Starting in the first quarter of the year, these students began receiving financial support to pursue their professional studies at various universities across the country. Since 2014, this program has recognized the efforts of more than 300 young leaders in their communities, from the lowest economic strata (1 and 2), in areas where Grupo Argos, Cementos Argos, Celsia, and Odinsa operate. The consolidated investment of Grupo Argos Foundation in this program amounts to more than COP 10 billion.

Lastly, marking a true milestone for Grupo Empresarial Argos in its journey as a leading conglomerate in sustainability, the United States Department of Energy announced a list of high-impact projects aimed at reducing CO2 emissions, with initiatives totaling more than USD 20 billion, as a commitment to finding new technologies in the industry to combat climate change. A Summit Materials project was selected for a grant totaling USD 215.6 million for the construction of up to four calcined clay plants in the United States. This project was initially conceived by the innovation teams at Cementos Argos in Colombia, where the first calcined clay plant was established in 2016. This is a significant step in the effort to reduce the industry’s carbon footprint through cutting-edge investment and innovation.

Mas noticias

-

Financial results

Financial results -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more -

Business

BusinessWith solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months

14 November 2024With solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months.

Read more -

Corporate

CorporateGrupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

14 August 2024Grupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

Read more -

Financial results

Financial resultsGrupo Argos closed 2023 with consolidated revenues of COP 22.6 trillion and a separate net income of COP 789 billion, its best financial results in 90 years of history

23 February 2024Grupo Argos closed 2023 with consolidated revenues of COP 22.6 trillion and a separate net income of COP 789 billion, its best financial results in 90 years of history

Read more