Financial results • News

Grupo Argos closed 2023 with consolidated revenues of COP 22.6 trillion and a separate net income of COP 789 billion, its best financial results in 90 years of history

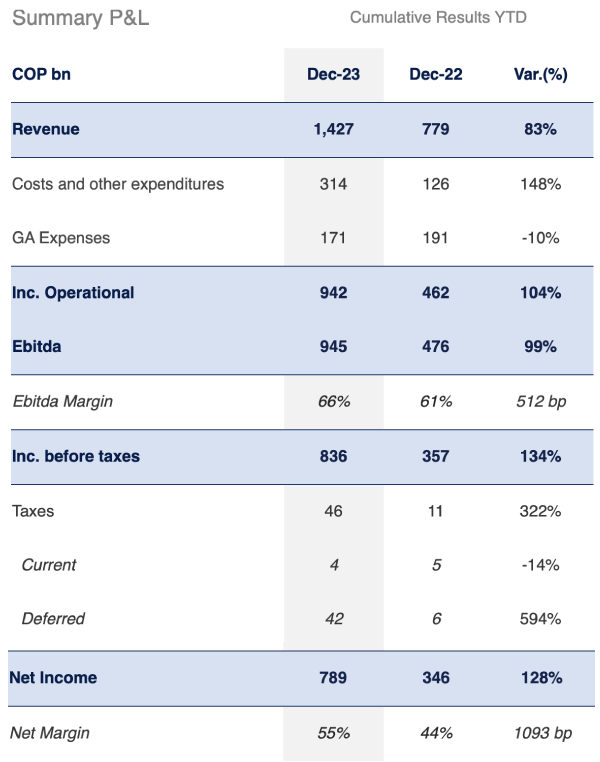

23 February 2024- In the separate results, revenues grew by 83%, EBITDA doubled, and net income increased by 128% compared to 2022.

- At the close of 2023, Cementos Argos reported consolidated revenues of COP 12.7 trillion, up 9%, while EBITDA rose to COP 2.6 trillion, a positive change of 22% compared to 2022.

- Celsia’s consolidated revenues at the end of 2023 reached COP 6.2 trillion, with an increase of 12%, and the consolidated EBITDA amounted to COP 1.8 trillion, growing by 4%.

- Odinsa closed with road traffic that rose to more than 38 million vehicles, while the airport vertical mobilized 46 million passengers.

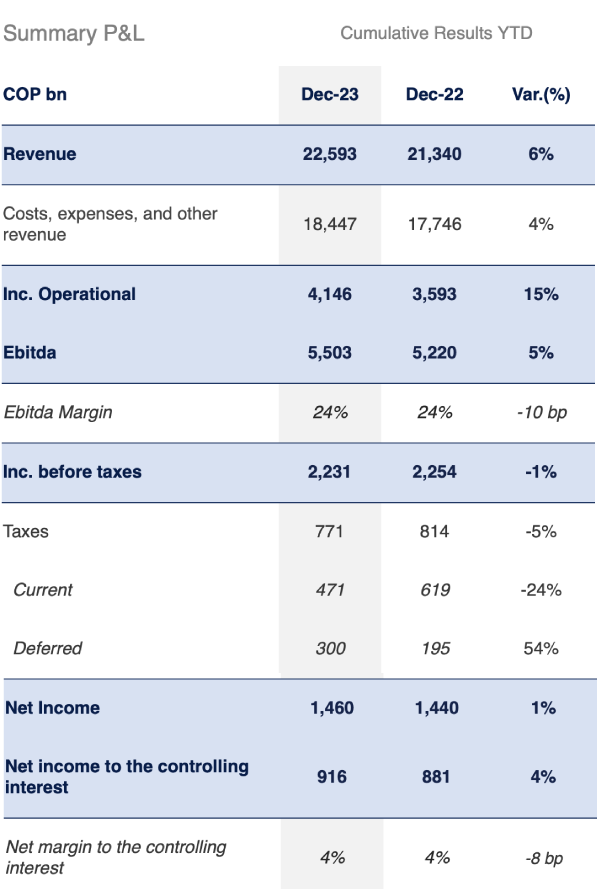

Grupo Argos’ results demonstrated the strength of all its businesses during 2023, which allowed the company to achieve separate revenues of COP 1.4 trillion (+83%), an EBITDA of COP 945 billion (+99%), and a net income of COP 789 billion (+128%). On a consolidated level, revenues reached COP 22.6 trillion (+6%), while EBITDA was COP 5.5 trillion (+5%), and net income closed at COP 1.5 trillion (+1%).

“In 2023 we achieved historic results that reaffirmed the fundamentals of our businesses and materialized transformational milestones, one of them being the asset combination between Summit Materials and Argos USA, an operation that consolidates this organization as the most important Colombian investor in the United States, and another, the exchange agreement of Grupo Argos’ stake in Nutresa. Both are achievements that consolidate the company as a relevant player in the infrastructure sector.”

Jorge Mario Velásquez President of Grupo Argos

Grupo Argos continues to focus on revealing value to its more than 15,000 shareholders, among which are more than 18 million savers in the country through pension funds, which is why since 2018 it has doubled its dividend and this year will propose a 10.6% growth at its Shareholders’ Meeting, equivalent to a dividend per share of COP 636. The Grupo Empresarial Argos will continue to advance in the share buyback programs, in which to date COP 200 billion has been executed.

In addition to the realization of value to its shareholders via dividends and share buybacks, the organization will continue to deepen its investment efforts in Colombia with projects exceeding COP 2 trillion in 2024, among which initiatives for growth in non-conventional renewable energies, strengthening of cement dispatch operations, structuring of infrastructure projects, and urban development works that are transforming the Colombian Caribbean stand out.

Cementos Argos closed 2023 with revenues of COP 12.7 trillion (+9%), while EBITDA rose to COP 2.6 trillion (+22%). The controlling net income reached COP 320 billion (+125%). The asset combination agreement between Argos USA and Summit Materials strengthened the company’s position as a relevant player in the industry in the world’s leading economy, capitalizing its investment, and generating an appreciation of more than 120% in the ordinary and preferred shares of Cementos Argos between the announcement date and the end of the year.

Celsia, for its part, recorded revenues of COP 6.2 trillion (+12%) and consolidated EBITDA totaled COP 1.8 trillion (+4%). During the year, the company reorganized its presence in Central America by divesting some assets, an operation that allowed it to improve its financial flexibility, strengthen its liquidity position, and reduce indebtedness, moving from a net leverage indicator over EBITDA of 3.0 times to 2.3 times.

Odinsa launched a new airport infrastructure investment platform, in partnership with Macquarie Asset Management, which includes assets of more than COP 1.3 trillion and opens the way to develop relevant infrastructure projects in Colombia and the region. At the end of 2023, the road platform recorded traffic that rose to more than 38 million vehicles, while the airport vertical mobilized 46 million passengers, of which more than 40 million correspond to El Dorado International Airport, a record figure for this asset.

Finally, Grupo Argos’ Urban Development Business closed the year with a record in its net cash flow of COP 105 billion, 76% above the average recorded since 2016, and the signing of new contracts for COP 244 billion, for a committed cash flow in which it will receive COP 314 billion over the next four years.

Summary of the separate financial results

Summary of the consolidated financial results

Integral value generation: well-being and development for Colombians

The S&P Global Sustainability Yearbook highlighted the four companies of the Argos Business Group among the most sustainable in the world for their management of environmental, social, and corporate governance issues. This assessment, which evaluates more than 9,300 organizations globally, emphasized the work done by Grupo Argos, Cementos Argos, Celsia, and Odinsa to develop a sustainability strategy that allows them to reduce the impact of their operations while generating comprehensive value for their stakeholders.

Additionally, in 2023, with the purpose of contributing to the development of regions in Colombia, the Social Value Creation program led the initiation of the execution of approximately COP 72 billion in 12 road infrastructure and education projects in Antioquia, Cauca, Sucre, Tolima, and Valle del Cauca, through the Tax-for-Projects mechanism. Likewise, the organization committed to new projects already approved under this mechanism for an amount close to COP 90 billion that will be invested in initiatives for secondary roads and education in Antioquia, Cauca, and Valle del Cauca.

Mas noticias

-

Financial results

Financial results -

News

NewsGrupo Argos and its companies, Cementos Argos and Celsia, reaffirm their leadership among the most sustainable companies in Colombia, according to Merco

26 February 2025 Read more -

Grupo Argos Foundation

Grupo Argos Foundation18 young people from 11 municipalities in Antioquia became the first cohort of Generación A, the professional scholarship program of Fundación Grupo Argos and the universities EIA, EAFIT, and CES

12 February 2025 Read more -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more -

News

NewsFull opening of the first section of Parque El Tesoro, a recreational and cultural space serving the community of Puerto Colombia and the metropolitan area

16 January 2025With the opening of its first section, Parque El Tesoro, located in Puerto Colombia, now offers 18,656 m² of public space, incorporating new areas for community well-being, including two tennis courts, rest areas, and extensions to both the bike path and contemplative trails.

Read more