Corporate • News

Grupo Argos and Grupo Sura sign a Spin-Off Agreement through which Grupo Argos shareholders will directly receive the company's investment in Grupo Sura

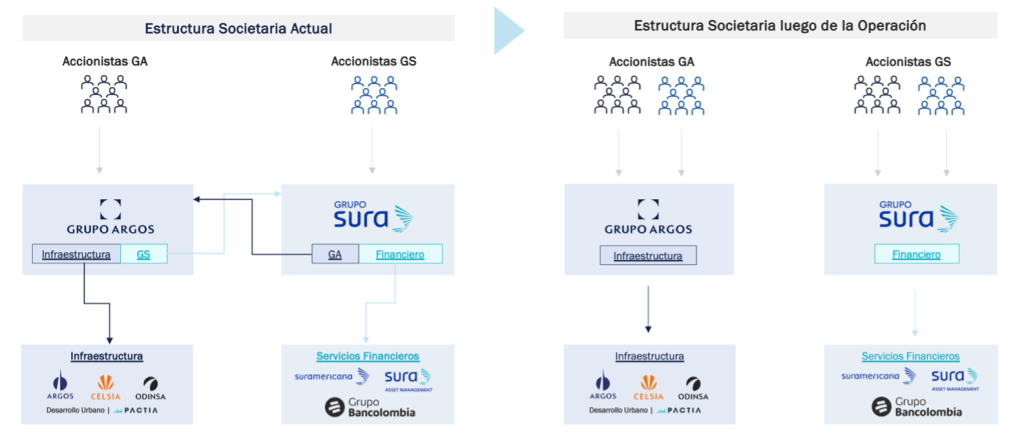

18 December 2024- Grupo Argos and Grupo Sura agreed to eliminate their cross-shareholdings through spin-offs, which will be executed simultaneously.

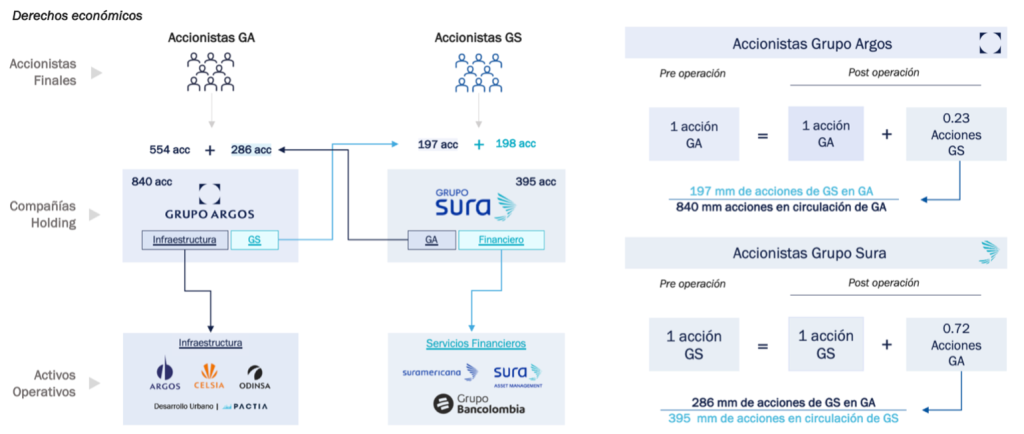

- Upon completion of the transaction, each Grupo Argos shareholder will retain their existing shares and, additionally, receive 0.23 shares of Grupo Sura for each share of Grupo Argos they initially held. Similarly, each Grupo Sura shareholder will maintain their existing shares in the company and receive 0.72 shares of Grupo Argos for each share of Grupo Sura they held prior to the transaction.

- As a result, Grupo Argos shareholders will obtain a direct stake in both Grupo Argos and Grupo Sura, maintaining the same economic value they initially held in one company, but now represented as a stake in both companies.

- This operation aligns with the company’s objectives to efficiently manage its stake in Grupo Sura, bring an organized end to the cross-shareholdings between Grupo Argos and Grupo Sura, deepen Grupo Argos’ specialization as an investment manager in infrastructure, continue the organization’s business plan, and ensure equitable treatment for all shareholders of the involved companies.

- The spin-offs will be submitted for approval to the Shareholders’ Meetings of the companies and are subject to regulatory authorizations.

Grupo Argos and Grupo Sura have signed a Spin-Off Agreement through which they agreed on a transaction to eliminate the cross-shareholdings they have maintained for over 46 years — a relationship that has enabled both companies to become leaders and benchmarks in their respective sectors. This will be achieved through absorption spin-offs, which will be simultaneously approved and executed.

This operation will achieve the following objectives:

- Direct Participation for Shareholders: Grupo Argos shareholders will retain their direct stake in Grupo Argos and also receive a direct stake in Grupo Sura, maintaining the same economic value they initially held.

- Simplification of the Shareholding and Portfolio Structure: The structure of Grupo Argos’ shareholding and investment portfolio will be simplified in line with current market trends and investor preferences.

- Increased Focus on Core Sectors: Grupo Argos will strengthen its focus on the construction materials and infrastructure sectors, enhancing its capabilities and advancing its business plan.

“The cross-shareholding structure has far exceeded its objective: Grupo Argos consolidated its presence across the Americas, achieving a compound annual growth of 21% in shareholder equity over the past 46 years and positioning Cementos Argos, Celsia, and Odinsa as regional leaders in their sectors. The simplification of the shareholding structure and portfolio will become another significant milestone in the disclosure and transfer of value to all Grupo Argos shareholders. This move aligns with investor appetite and market trends, while preserving the essence of the business philosophy that has always characterized this organization.”

Jorge Mario Velásquez

President of Grupo Argos

Transaction Summary

This is a single operation in which each shareholder of Grupo Argos will retain their stake in Grupo Argos and receive a direct stake in Grupo Sura, thereby ending the cross-shareholdings.

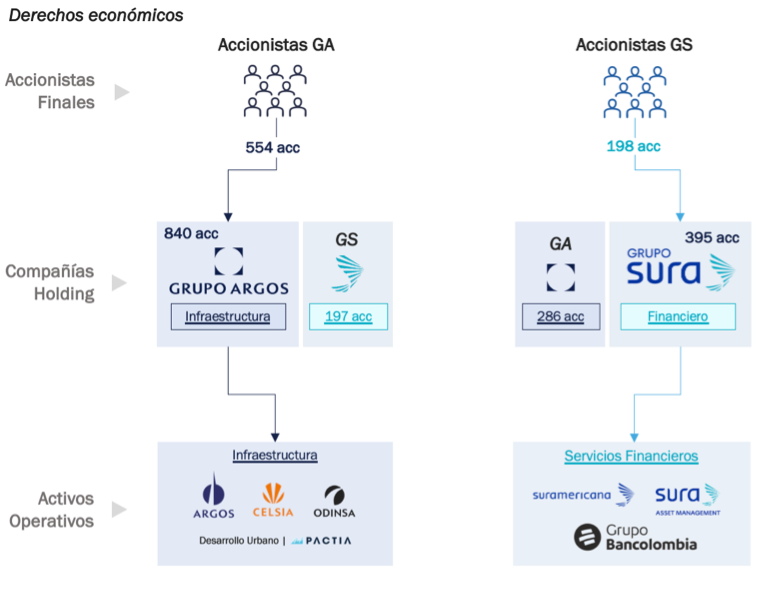

Below is a step-by-step description of the transaction structure:

Watch the explanatory video of the transaction:

1. Spin-off:

Grupo Argos will spin off its investment in Grupo Sura (197 million shares) in favor of Grupo Sura. In turn, Grupo Sura will spin off its investment in Grupo Argos (286 million shares) in favor of Grupo Argos.

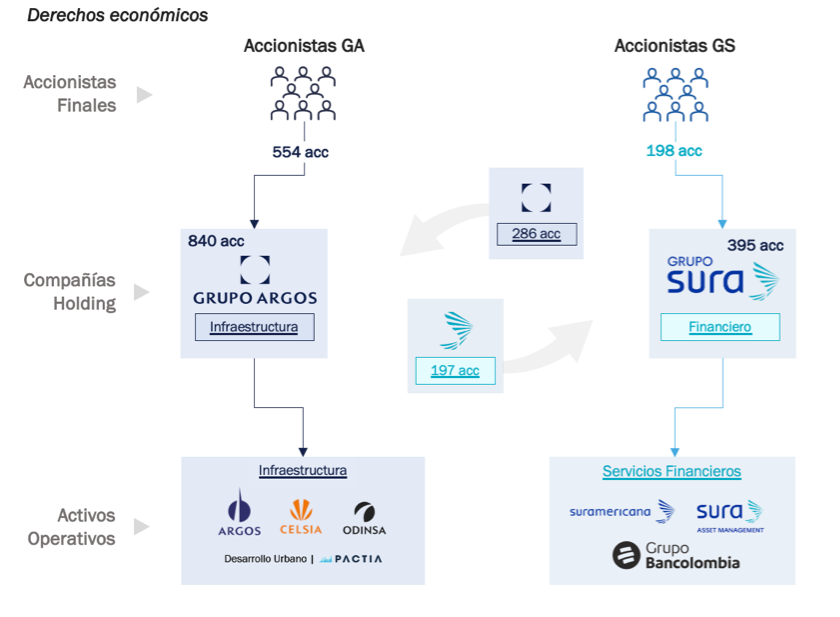

2. Absorption:

Grupo Argos will absorb the investment that Grupo Sura held in Grupo Argos (286 million shares). At the time of this absorption, the shares will be canceled.

Similarly, Grupo Sura will absorb the investment that Grupo Argos held in Grupo Sura (197 million shares). At the time of this absorption, the shares will be canceled.

3. Issuance:

Grupo Argos will issue 286 million shares in favor of all Grupo Sura shareholders in exchange for the own shares it received from Grupo Sura. Since Grupo Argos was one of the shareholders of Grupo Sura, the shares corresponding to Grupo Argos will be canceled, thereby increasing the ownership percentage of all other Grupo Argos shareholders.

Similarly, Grupo Sura will issue 197 million shares in favor of all Grupo Argos shareholders, including Grupo Sura, in exchange for the own shares it received from Grupo Argos. Since Grupo Sura was one of the shareholders of Grupo Argos, the shares corresponding to Grupo Sura will be canceled, thereby increasing the ownership percentage of all other Grupo Sura shareholders.

The common shareholders of the company being spun off will receive common shares of the beneficiary company. Meanwhile, the preferred shareholders will receive preferred shares.

At the end of the transaction, each shareholder of Grupo Argos will keep their current shares in Grupo Argos — which will represent a 20% greater percentage of participation in the economic rights of the company — and will receive 0.23 shares of Grupo Sura for each share they initially held. In the case of Grupo Sura, each shareholder will maintain their current shares in Grupo Sura and will receive 0.72 shares of Grupo Argos for each share they had before the transaction.

This means that a hypothetical 5% participation in the economic rights of Grupo Argos, after the transaction, will represent a 6% participation in Grupo Argos, in addition to a new 3% participation in Grupo Sura. Similarly, a hypothetical 5% participation in the economic rights of Grupo Sura, after the transaction, will represent a 6% participation in Grupo Sura, in addition to a new 2% participation in Grupo Argos.

These ratios are due to the existing relationship between the total number of outstanding shares of the companies and the number of shares they hold as cross-ownership.

This operation will be submitted for consideration by the Shareholders’ Meetings of Grupo Argos and Grupo Sura, in accordance with corporate governance guidelines and applicable regulations. Government authorizations will also be processed, including those required from the Superintendencia Financiera de Colombia.

The company will hold an investor conference on Thursday, December 19, to explain the terms of the transaction.

See statements from Jorge Mario Velásquez, President of Grupo Argos:

1. The number of shares to be spun off and the referenced ratios have considered that (i) Cementos Argos will dispose of its stake in Grupo Sura so that its shareholders will directly hold a stake in that company, resulting in Grupo Argos receiving approximately 15 million additional shares of Grupo Sura beyond those it currently holds, and (ii) the shares owned by vote-inhibiting trust will also be part of the transaction. These ratios may change due to variations in the number of outstanding shares of Grupo Sura and Grupo Argos at the time the spin-offs are finalized.

Mas noticias

-

Corporate

Corporate -

News

NewsGrupo Argos and its companies, Cementos Argos and Celsia, reaffirm their leadership among the most sustainable companies in Colombia, according to Merco

26 February 2025 Read more -

Corporate

CorporateGrupo Argos' preferred share grew 5.4 times more than the MSCI Colcap during 2024

17 February 2025 Read more -

Grupo Argos Foundation

Grupo Argos Foundation18 young people from 11 municipalities in Antioquia became the first cohort of Generación A, the professional scholarship program of Fundación Grupo Argos and the universities EIA, EAFIT, and CES

12 February 2025 Read more -

News

NewsFull opening of the first section of Parque El Tesoro, a recreational and cultural space serving the community of Puerto Colombia and the metropolitan area

16 January 2025With the opening of its first section, Parque El Tesoro, located in Puerto Colombia, now offers 18,656 m² of public space, incorporating new areas for community well-being, including two tennis courts, rest areas, and extensions to both the bike path and contemplative trails.

Read more