Financial results

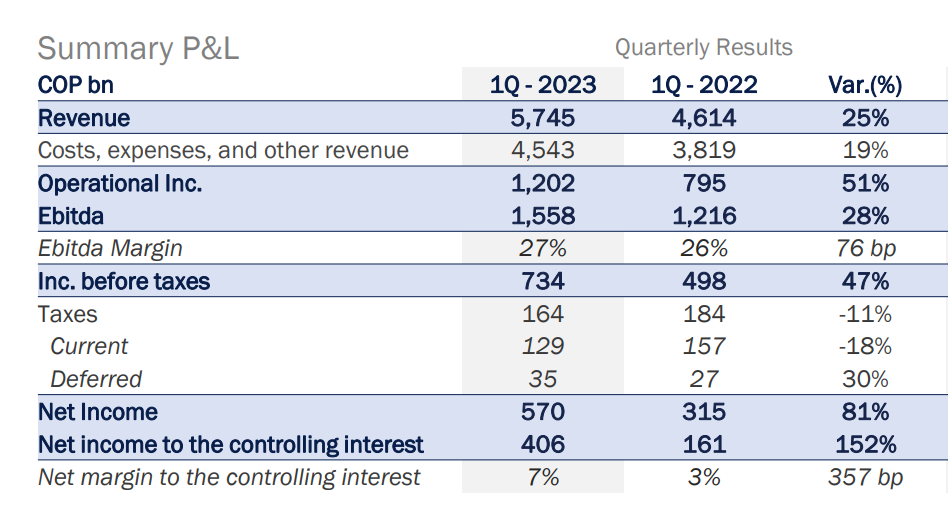

Grupo Argos achieved historic results: revenues reached COP 5.7 trillion (+25%), EBITDA reached COP 1.6 trillion (+28%), and net income reached COP 570 billion (+81%).

10 May 2023- Cementos Argos delivered a positive performance across its three regions: in Colombia, it achieved a 39% growth in EBITDA, in Central America, a 2% growth, and in the United States, an impressive 77% growth. Meanwhile, Celsia continued to strengthen its solar and energy transmission and distribution platforms, reporting in a consolidated EBITDA growth of 13%. Odinsa recorded an 18% increase in passenger traffic in its airport concessions, while its road infrastructure experienced a 3% growth in traffic.

- During the first quarter of the year, Grupo Argos initiated its share buyback plan through the transactional mechanism of the Colombian Stock Exchange. This process will resume in May with the execution of a plan for up to COP 500 billion over the next three years.

- Between January and March 2023, Grupo Argos acquired 13.5 million ordinary shares of Cementos Argos, representing an additional 1.2% stake in this business. With this and other measures, Grupo Argos reaffirms its confidence in its strategy and business plan of all its companies.

In the first quarter of 2023, Grupo Argos continued its growth trajectory with financial results that grew above 25%, driven by a positive performance in all its operations. During this period, consolidated revenues amounted to COP 5.7 trillion, a 25% increase compared to the same period last year. EBITDA reached COP 1.6 trillion, representing a growth of 28%, and net income stood at COP 570 billion, marking an 81% increase. The net income of the controlling company reached COP 406 billion, growing152%. Recently, S&P Global reaffirmed the highest credit ratings for Grupo Argos and its ordinary bonds. Similarly, the short-term debt of commercial papers was confirmed as BCR1+.

“Grupo Argos’ net controlling income for the first quarter was 2.5 times higher than that of the same period of the previous year, which is equivalent to about COP 470 per share and anticipates the generation of profits for the year to continue distributing more dividends and value for our shareholders in the future”. Jorge Mario Velásquez – Grupo Argos CEO

Cementos Argos reported a strong first quarter with revenues of COP 3.4 trillion, a growth of 31% compared to the same period last year. The EBITDA closed at COP 594 billion, showing a significant increase of 65%, and the EBITDA margin expanded by over 350 basis points. The performance of the operation in the United States stands out, with a 7% increase in cement volumes compared to the previous year, driven by positive dynamics in the non-residential and infrastructure segments. Additionally, cement exports from Colombia to the United States saw an increase of 81%.

Celsia recorded consolidated revenues of COP 1.5 trillion during the first quarter of the year, representing a growth of 16% compared to the same period in 2022. The EBITDA closed at COP 514 billion, showing a 13% increase. When considering the performance of different platforms, the EBITDA reached COP 620 billion, with a growth of 25%. As a significant development, the energy company of Grupo Argos recently announced the sale of part of its assets in Central America for USD 194 million. This transaction will strengthen Celsia’s liquidity position, improve return on invested capital, reduce consolidated debt, and provide financial resources and flexibility to continue executing its strategy. Furthermore, the company will have liquid resources to carry out the ongoing share repurchase program authorized by its Shareholders’ Assembly on March 29th.

Odinsa concluded the first quarter of the year with outstanding performance in its airport concessions, handling 10.4 million passengers, which represents an 18% growth compared to the same period in 2022. Despite the challenging conditions in the national aviation market, which affected domestic traffic dynamics, Odinsa demonstrated resilience. In the quarter, Fitch Ratings confirmed Opain’s BB+ rating and revised its outlook to stable, considering the recovery in traffic observed at El Dorado Airport. In terms of road infrastructure, Odinsa recorded a 3% growth compared to the same quarter of the previous year. The performance of the Túnel de Oriente stands out, with an 8% increase in traffic.

Grupo Argos’s Urban Development Business achieved extraordinary results, with a cash flow that exceeded nearly 500% compared to the same period of the previous year. This business has guaranteed revenues of COP 400 billion for the next five years. Since 2019, the Urban Development Business has contributed separate state incomes of approximately COP 1 trillion to Grupo Argos. Furthermore, it is positively transforming the growth of Barranquilla and Barú with the highest planning standards, as well as developing top-notch urban and hotel infrastructure.

Transfer of value to shareholders

During the first quarter, Grupo Argos continued to advance initiatives to transfer value to its shareholders. In the ordinary meeting of its Assembly, a 15% increase in dividend distribution was decreed, representing over COP 499 billion in capital. In line with this, in May, the organization will be able to commence the execution of a share buyback plan of up to COP 500 billion over a three-year period, following the continuation of the repurchase process initiated in March 2023, through the transactional mechanism of the Colombian Stock Exchange. Furthermore, during the early months of the year, Grupo Argos purchased 13.5 million shares of Cementos Argos, increasing its stake in the construction materials company by 1.2%. With these initiatives, the organization reaffirms confidence in the business plan and strategy being executed by Grupo Argos and its affiliated companies.

Consolidated Financial Results Summary

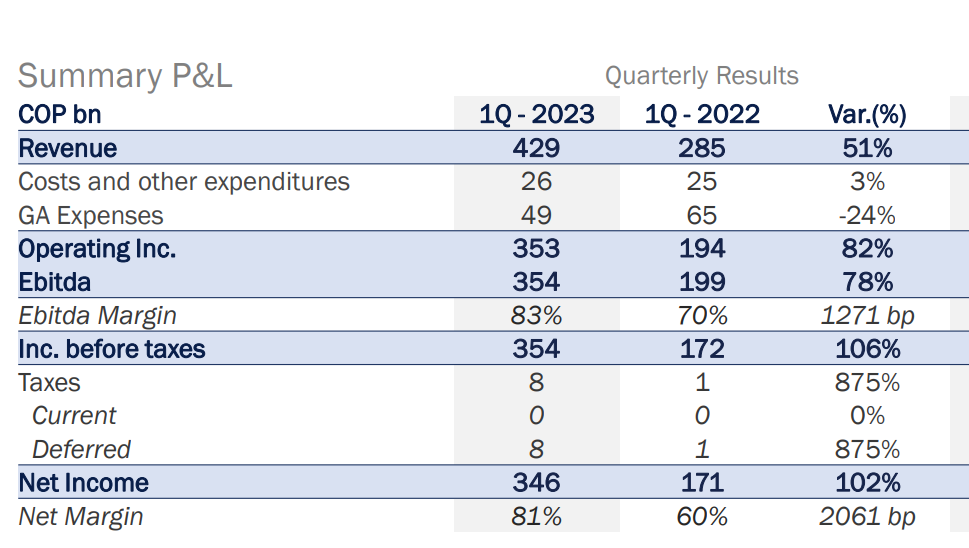

Separate Financial Results Summary

Comprehensive value generation: well-being and development for Colombians

During the quarter, Grupo Argos continued to work on initiatives connected to the social and environmental agenda in Colombia, in line with its vision of comprehensive value creation: (i) energy transition, (ii) climate change, and (iii) equity and inclusion. In the energy transition front, Celsia facilitated the creation of the first energy community in Valle del Cauca as a pilot project. It includes the development of an agrovoltaic solar system that will provide electricity to the residents of Bocas del Palo in Jamundí. Regarding climate change, the company established four agreements with the National University of Colombia to develop adaptation and mitigation solutions with the goal of achieving a 46% reduction in emissions intensity by 2030. Finally, in terms of equality and inclusion, Grupo Argos initiated a process to strengthen the procurement of products and services with a gender perspective through the Sourcing2Equal initiative, an IFC program that connects women entrepreneurs with new markets. This project allows the Grupo Empresarial Argos to extend its diversity and inclusion policy and expand its impact, aligning with the internal efforts that have positioned it as a global benchmark for gender equity.

Mas noticias

-

Financial results

Financial results -

Financial results

Financial resultsGrupo Argos closed 2024 by more than tripling its separate net income, reaching COP 2.5 trillion.

30 January 2025 Read more -

Business

BusinessWith solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months

14 November 2024With solid results at the end of the third quarter, Grupo Argos' market capitalization has doubled over the past 12 months.

Read more -

Corporate

CorporateGrupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

14 August 2024Grupo Argos reports a net profit of COP 2.6 trillion from its divestment in Nutresa and shows a 41% growth in its EBITDA

Read more -

Financial results

Financial resultsGrupo Argos closed the first quarter with a net profit of COP 6.5 trillion as a result of transformational transactions

15 May 2024Grupo Argos closed the first quarter with a net profit of COP 6.5 trillion as a result of transformational transactions

Read more